kentucky income tax calculator

Your average tax rate is 1198 and your marginal. Check the box - Advanced KYS Income Tax Calculator.

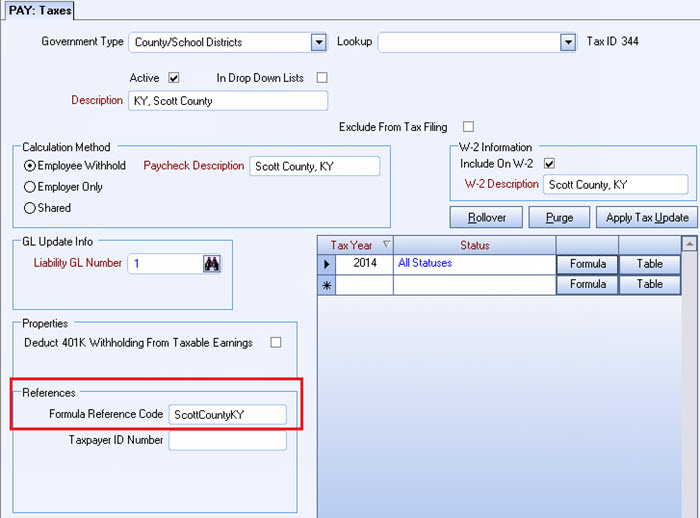

Kentucky County School District Taxes

Our calculator has recently been updated to include both the latest Federal Tax.

. The personal income tax in Kentucky is a flat rate for all residents. The Federal or IRS Taxes Are Listed. The Kentucky Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

When you choose Community Tax you gain access to our intelligent Kentucky tax calculator. If you make 81500 a year living in the region of Kentucky USA you will be taxed 14858. SUI rates in Mississippi range from 0 to 54.

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. The range we have provided in the Kentucky income tax calculator is from 1200 per month or 14400 per year to 12000 per month or 144000 per year. Confirm Number of Dependants.

The Kentucky tax tables here contain the various elements that are used in the Kentucky Tax Calculators. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Your average tax rate is 1340 and your marginal.

1 day agoYet more would likely be due to the IRS at tax time. How to use the advanced Kentucky tax calculator. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Understand your income tax liability Taxable income Income tax rate Income tax liability minus any tax liability deductions withholdings Net income Income tax liability. Just enter the wages tax withholdings and other information required. On the next page you will be able to add more details like itemized.

Kentucky Income Tax Calculator 2021. Underpayment of Estimated Income Tax or Limited Liability Entity Tax LLET for tax years beginning on or after January 1 2019- The amount of the underpayment or late. You can use our free Kentucky income tax calculator to get a good estimate of what your tax liability will be come April.

Still the state does impose Social Security and Unemployment Insurance SUI on employees. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

This income tax calculator can help estimate your average income. Kentucky Income Tax Calculator - TaxLeak. Kentucky Income Tax Calculator 2021.

These types of capital gains are taxed at 28 28. If your pension income is greater than 31110 you will need to complete Kentucky Schedule P Kentucky Pension Income Exclusion to determine how much of your pension income is. Confirm Number of Children you.

The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Kentucky State. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. The top federal income tax rate is 37 and this year applies to income above 539900 for individual tax filers and 647850 for.

You can use a Kentucky tax calculator to calculate your state tax refund. The taxable wage base in Mississippi is 14000. Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learn.

You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Since 2018 the state has charged taxpayers with a flat income tax. Kentucky State Personal Income Tax Rates and Thresholds in 2023.

Kentucky Income Tax Calculator 2022 2023

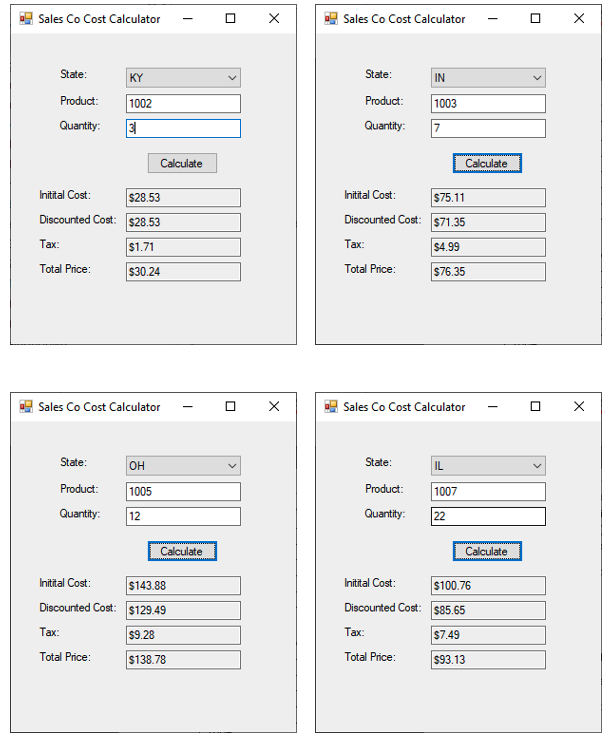

Kentucky Sales Tax Calculator And Local Rates 2021 Wise

Kentucky Income Tax Calculator Smartasset

Tax Deadlines Extended For Employers In Eastern Kentucky The Bottom Line

Solved State Tax Ky Kentucky 6 00 Oh Chegg Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Peoplesoft Payroll For North America 9 1 Peoplebook

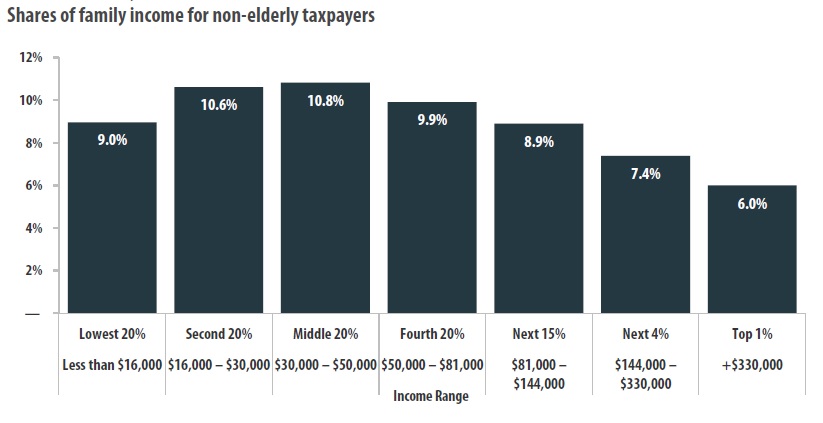

Kentucky S Tax Structure Is Not Fair Kentuckians For The Commonwealth

A Complete Guide To Kentucky Payroll Taxes

Mortgage Calculator Kentucky New American Funding

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Kentucky Paycheck Calculator Smartasset

Kentucky Municipality Taxes Is There A Way To Simplify Inscipher

13 States That Tax Social Security Benefits Tax Foundation

Income Tax Calculator 2021 2022 Estimate Return Refund

Kentucky Income Tax Rate And Brackets 2019

Tax Withholding For Pensions And Social Security Sensible Money